Verification Selections

What is Verification?

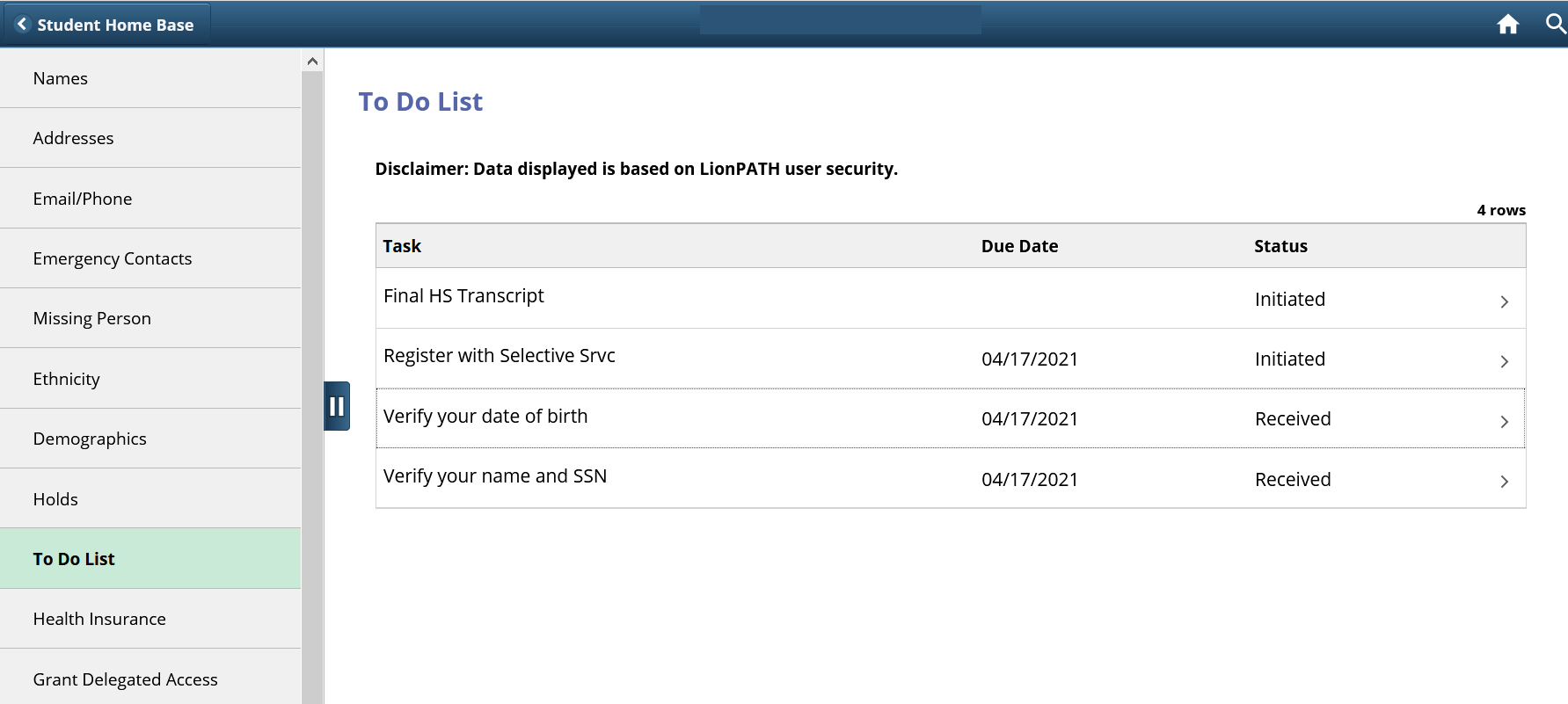

Verification is a federal regulation that requires colleges and universities to verify the information provided by students and parents on the Free Application for Federal Student Aid (FAFSA). Colleges and universities have varying rules regarding who must be selected for verification. If you have submitted your FAFSA to multiple schools, they may have different selection criteria than Penn State. Just because one school has asked you to submit something does not mean that you should submit it to all the schools to which you have applied. We will notify you via your Penn State email if you have been selected for verification. You can find your verification prompts in the "To Do List" located within the Student Home Base in LionPATH.

Didn’t I already answer this on the FAFSA?

Yes, you did already answer these questions or provide the information on the FAFSA. Just like the IRS sometimes audits the information people put on their tax returns, verification is the Department of Education’s audit process, to make sure that people are completing the FAFSA correctly.

Do I have to comply/fill out the Forms?

Once you have been selected for verification a hold is placed on your federal financial aid. Your financial aid will remain on hold until documentation is received, reviewed, and corrections are transmitted to the Department of Education (i.e. we will submit an updated copy of your FAFSA based on the information that you have submitted). If you or your parent do not comply with the verification request, we cannot disburse your federal financial aid. Your aid may eventually be canceled if you do not comply with the verification request. If canceled due to non-compliance, there are no guarantees that we will be able to reinstate your financial aid if you comply with the request after your due date or the end of your enrollment period. You will be responsible for any unpaid charges that remain on your student account as a result of your aid being cancelled.

All documents should:

- Be signed by the student and parent (if the student is a dependent)

- Include the student's 9-digit Penn State I.D. number

- Not have blanks— if the answer to a question is zero, enter the number “0” (zero)

How do I know if I have been selected? What do I do?

We will notify you via your Penn State email if you have been selected for verification. You can find your verification prompts in the "To Do List" located within the Student Home Base in LionPATH:

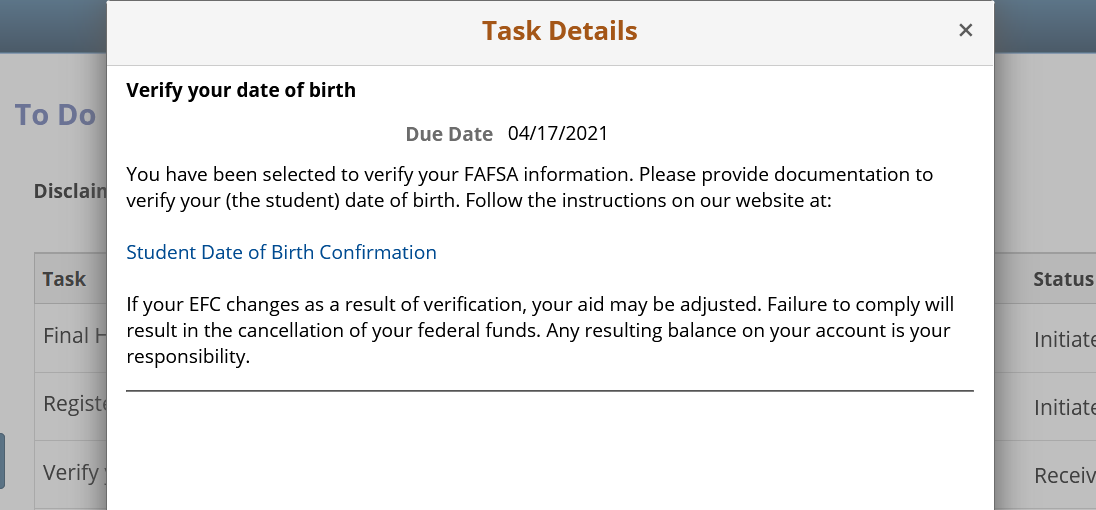

When you click on the to do item (it will be hyperlinked), you will open a screen with details on your verification request.

In order to open the verification instructions and form that needs to be sent to us, click on the link in your To Do List Item.

This link will forward you to our website where you will find instructions and a form to print and complete. Dependent student documents will require a parental signature.

You can send your documentation by FAX, U.S. Mail, or through our document upload system. Instructions for all methods are available from each verification form (from your to-do list in LionPATH) and on our contact page.

I submitted the documentation. How do I verify that it was received? What if there is an issue?

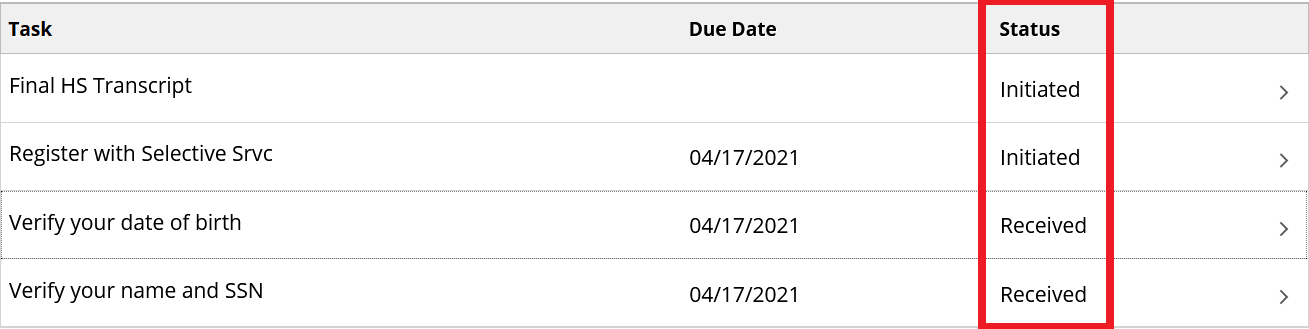

Click on the To Do List tab to see details on the status of your verification documents. If you sent in documentation and we have received it, the item will appear as "received" as shown below. Please do not send us multiple copies of your verification documents if we have already received them. Please allow a few business days for your checklist item to show Status = Received.

Please monitor your @psu.edu email and LionPATH accounts. We will reach out to you if there is an issue with your upload or we require additional documentation.

I have been selected for the Student or Parent Tax information, what paperwork can I submit or should I use the IRS Data Retrieval Tool (DRT) within the FAFSA?

IRS DRT:

The IRS Data Retrieval Tool is the recommended Method for submitting your parent and/or student tax information.This tool is the fastest, most accurate way to input tax return information into the FAFSA form. Go to https://studentaid.gov/h/apply-for-aid/fafsa, select the "Make FAFSA Correction" link and then the "Financial Information" tab. Continue through the screens until you click "Submit". You can view the full tutorial here.

Tax Return:

You can also provide a legible, signed copy of page one and two of IRS Form 1040, 1040A, 1040EZ, a tax return from Puerto Rico or a foreign income tax return filed for the specified year. Note: Foreign tax returns must have each line translated to English.

Options for taxpayers who did not keep a copy of their tax return or require a verification of non-filing letter:

- Access the tax software product used to prepare and file their tax return. They may be able to access their account to download and print a copy.

- Contact the tax preparer or provider who filed their tax return.

- To access your transcript immediately, download your tax transcript at Get Transcript Online. Review the identity authentication requirements for Secure Access before attempting to register.

- Use Get Transcript by Mail. The IRS will mail a transcript to the address on your return within 10 days.

- File Form 4506-T. The IRS will mail a transcript to the address on your return within 10 days.

- Call the IRS’s automated line at 800-908-9946 to order a transcript by mail. The IRS will mail a transcript to the address on your return within 10 days.

- Taxpayers who filed an amended tax return, Form 1040-X, should use the adjusted gross income and earned income listed on their revised tax return.

Alternative documentation for Information Document Request (IDR) applications:

- IRS Data Retrieval plan applicants must submit alternative documentation of income.

- The applicants submit this documentation to their federal loan servicers after completing and submitting the online IDR application.

- The process for submitting the alternative documentation of income is explained to borrowers as part of the online IDR application.Alternative documentation of income usually consists of copies of pay stubs or most recently filed tax returns.

It appears that something has been added to my "To Do List". What does that mean?

Sometimes the answers you provide on your original verification forms may trigger us to select you for an additional item. If you are selected for an additional item, then the new item will appear on your "To Do List" with a new due date. Please monitor your list for completion of all verification items.

How long will it take to process my verification documents?

Processing verification is a manual process, and may take several weeks. We appreciate your patience as we work through high volume processing times. Monitor your Student Services Center in LionPATH. When the verification process is complete, the item in the "To Do List" will disappear.

We recommend not waiting until you return for the semester to submit your forms, as this will cause a large spike in volume and processing times and may result in greater delays to the disbursement of your federal aid. Our upload function does not connect directly with LionPath. Please allow a few business days for your checklist item to show Status = Received.

Will my financial aid be adjusted?

If your EFC changes as the result of verification, your financial aid may be adjusted. Monitor your Financial Aid Offer and PSU e-mail. When an aid adjustment is made, LionPATH will trigger and send an e-mail to the student. Any resulting balance on the account will be your responsibility.