Private Alternative Loan for a Previous Balance

Federal or institutional sources are not available to cover a balance from a previous semester. There are private alternative loan lenders that will allow to your borrow a loan for a period within the previous 12 months (365 days).

Previous semester balance

Sometimes you can end a semester with a balance owed due to changes in your aid eligibility or changes to your academic status.

Select a Lender

Neither Penn State nor the Office of Student Aid promotes, endorses, or recommends any loan products or lenders. You have the right to select the alternative lender of your choice. Your bank, credit union, or other financial institution can be a good place to start your search for a reputable alternative loan lender.

Eligibility, rates, terms, and conditions will vary according to lender. Some of the most common requirements are that the borrower is enrolled in a degree program and is enrolled at least half-time. The interest rate that you are offered will be dependent on your credit worthiness.

Select a loan term

It is important to select the correct loan term. To cover a balance for Summer 2021, you will need to select the loan term from the 2020-21 academic year. To cover a balance for Fall 2021 and/or Spring 2022. you will need to select the loan term from the 2021-22 academic year. We are not able to correct the loan term of a private alternative loan application.

Processing the loan

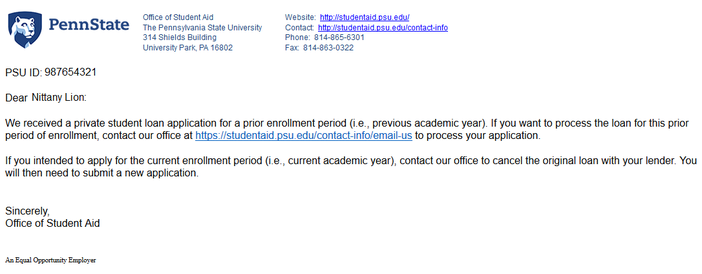

If you apply for a loan for a prior academic year, the application will be placed on hold and we will send a communication to your Penn State email notifying you that the loan certification request has been forwarded to us from your lender.

Contact our office to verify that you did intend to apply for a previous period of enrollment. We will process the loan and it will show on your Financial Aid Offer within approximately one to three business days. Once the loan shows on your Financial Aid Offer, you will need to accept the loan in order for the loan to appear as a credit on your bill.

If you no longer have access to LionPATH, contact our office after your loan is approved and we will assist you with completing the loan process.