Next Steps for Continuing Students

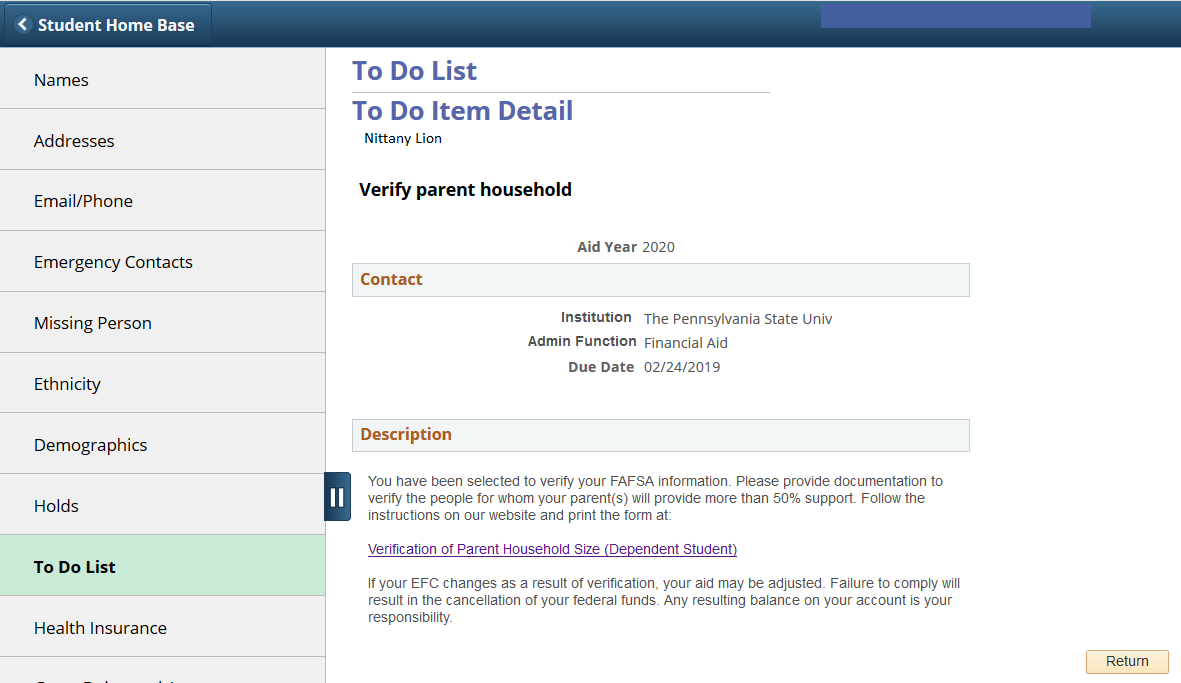

Respond to all Verification items on your 'To Do List'

Respond to all Verification items on your 'To Do List'

You may be selected for verification. Verification is a federal mandate requiring universities to confirm the accuracy of the information reported on the Free Application for Federal Student Aid (FAFSA). You will receive an email from our office, which explains what documentation must be provided if you and/or your parents are selected for verification. Verification requests will also be displayed on the "To Do List" located on the Home page of your LionPATH account.

Follow all directions, and respond quickly to this request to avoid a delay in the processing of your student’s aid. Often a parent signature is required on the verification documents.

Pennsylvania Residents: Check the Status of your State Grant

Pennsylvania Residents: Check the Status of your State Grant

Eligible Pennsylvania residents may receive an email from the Pennsylvania Higher Education Assistance Agency (PHEAA) asking for additional information.

Respond promptly.

Select "Sign-In" or "Create An Account" to check the status of your Pennsylvania State Grant at PHEAA.

Complete the Pre-Registration Activity Guide

Complete the Pre-Registration Activity Guide

This will be presented to you in your ‘To Do List’ after you have responded to your offer of admission.

This activity guide includes completing the Financial Responsibility Agreement (FRA). The Financial Responsibility Agreement is housed within the activity guide.

Accept, Decline, or Decrease your Financial Aid

Accept, Decline, or Decrease your Financial Aid

Keep in mind that we typically award for both Fall and Spring together, so you are accepting the total amount for the year. The exceptions would be if you applied for a one semester Graduate PLUS or Private Alternative Loan.

The following types of aid must be accepted in order to be applied to your bill:

- Federal Direct Subsidized Loans

- Federal Direct Unsubsidized Loans

- Graduate PLUS Loans

- Private Alternative Loans

- University Loans

Federal Work Study does have to be accepted, but DOES NOT appear as a credit on the bill. Federal Work-Study allows you to earn money to help cover non-billable educational expenses by working. Wages are direct-deposited into your checking or savings account every two weeks.

Scholarships, Federal Pell, and PHEAA State grants will be automatically accepted by the system once it is determined that the student is eligible for the award.

Click here for more information about how to accept, decrease, or decline your financial aid.

First Time Loan Borrowers Must Complete Entrance Counseling and a Master Promissory Note (MPN) for Federal Direct Loans

First Time Loan Borrowers Must Complete Entrance Counseling and a Master Promissory Note (MPN) for Federal Direct Loans

To accept and receive your Federal Direct Subsidized and Unsubsidized Loans, first-time borrowers must complete both of these steps on studentaid.gov:

- Complete Entrance Counseling

- Sign your Master Promissory Note (MPN)

You may accept, decrease or cancel your Federal Direct Subsidized and/or Unsubsidized Loan(s); however, we recommend waiting until after you have reviewed your fall semester tuition bill in August.

Research Additional Financial Strategies

Research Additional Financial Strategies

Financial aid typically covers only a portion of your educational costs and for the majority of Penn State students, these costs must be paid by the family using a combination of financing strategies.

Pay your Statement

Pay your Statement

Fall bills will be generated in August, Spring in December, and Summer in May. Typically they will be generated on the 1st and be due the 22nd. Please view your statement for specific deadlines and payment options or visit the Office of the Bursar for additional information.