Student Loan Debt Summary

The Student Loan Debt Summary is an annual notification of your cumulative student loan debt. Your Loan Debt Letter will be sent out to you each year that you are enrolled, near the end of Spring semester.

Review your current loan debt

You can find your federal loan servicer on studentaid.gov or by calling the Federal Student Aid Information Center at 800-4-FED-AID.

To view on studentaid.gov:

1. Log into your account with your FSAID and select "My Aid" from the drop down:

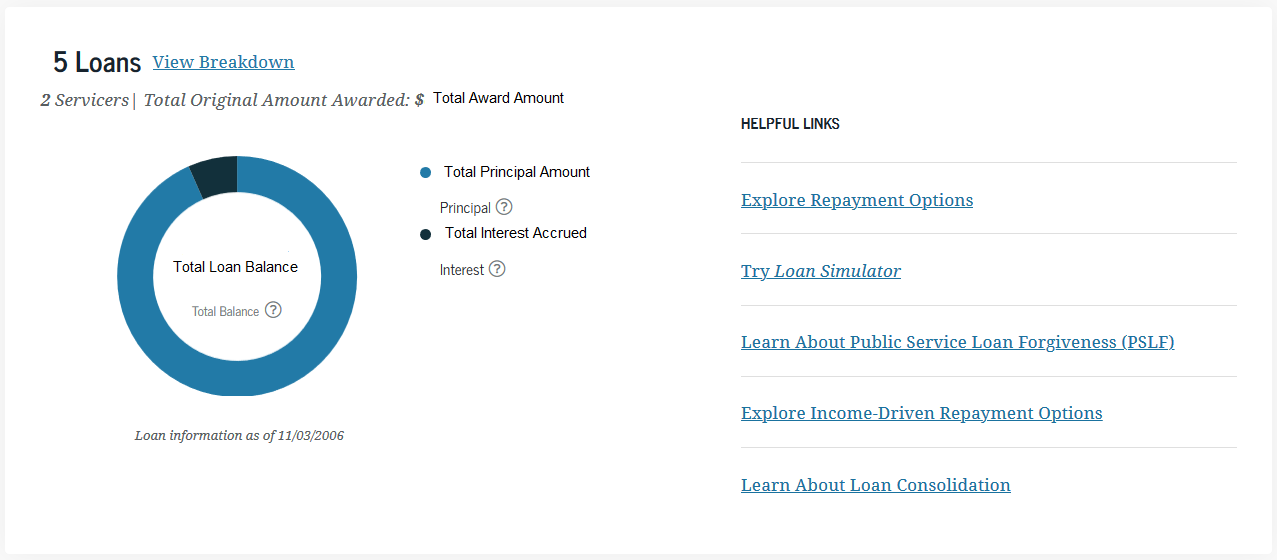

2. View your loan summary:

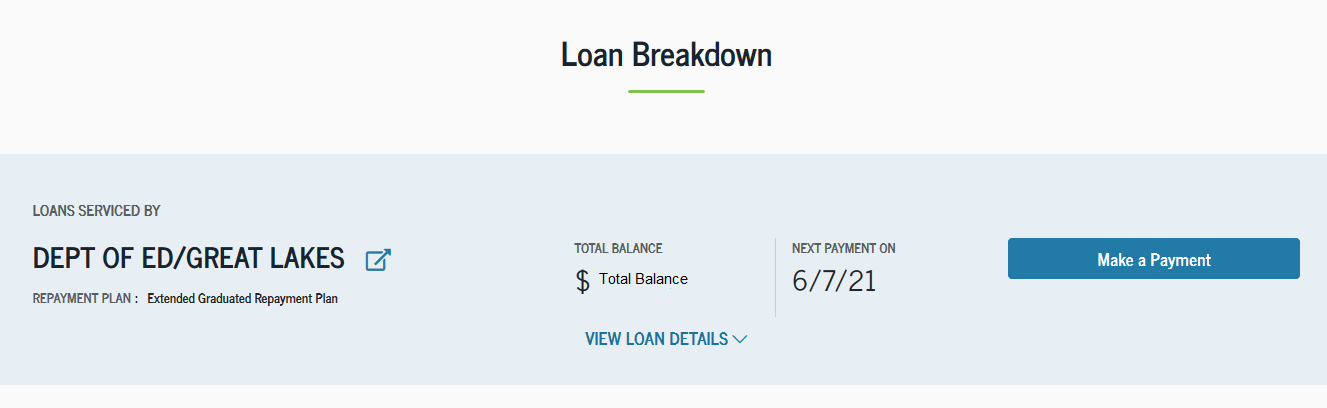

3. View loan servicer information:

Student Loan Debt Summary

The Student Loan Debt Summary includes:

- Federal Student Loans borrowed

- University Loans borrowed from Penn State

- Private Loans borrowed for enrollment at Penn State

Review your Interest Rates:

The following fixed interest rates are for Federal Direct Student Loans first disbursed on or after July 1, 2023 and prior to July 1, 2024:

| Loan Type | Interest Rate |

| Federal Direct Subsidized Loan for undergraduate students | 5.50% |

| Federal Direct Unsubsidized Loan for undergraduate students | 5.50% |

| Federal Direct Unsubsidized Loan for graduate students | 7.05% |

| Direct Graduate PLUS Loan for graduate Student | 8.05% |

| Federal Perkins Loan* | 5.0% |

| University Loan* | 6.0% |

*Perkins and University Loan Interest Rates do not change

Recommendations

Penn State is committed to your financial well-being and future success and realize that the best strategy for managing your student loan debt is to stay on track to complete your program in a timely manner. With this in mind, the Office of Student Aid would like to offer you this additional advice:

- Graduate on Time: Schedule an appointment with you Academic Adviser to make sure you are on track to graduate.

- Lower Your Student Loan Payments: Paying down the interest or principal on your loans while you are enrolled in school will lower your payments after graduation.

- Textbook Affordability: Research ways to reduce the cost of textbooks.

- Be informed: Meet with a financial professional from From Penn State's Sokolov-Miller Family Financial and Life Skills Center to help you make decisions regarding money management.

- Review their Money Counts: A Financial Literacy Series which includes:

- Self Study Modules

- Monthly webinars via Zoom

- Presentations

Financial tools on studentaid.gov

- Calculate your federal loan monthly payments

- Explore repayment plan options

Additional Resource

- Annualcreditreport.com - Review your individual credit score and your non-federal private student loans.