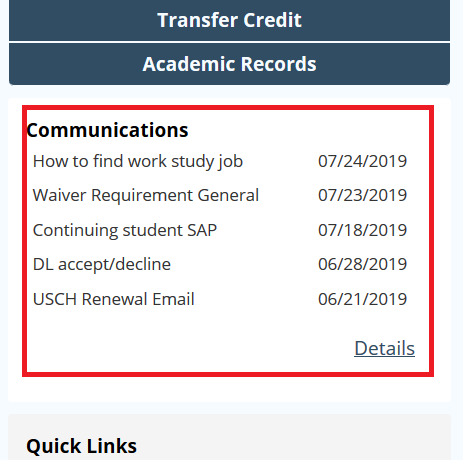

Communications

The following are examples of communications that may be sent to you regarding the status of your financial aid:

| Accept/ Decline your Loans | In order for your Direct Loan(s) to appear as a credit on your bill and to receive the loan funds, you must accept the loans in LionPATH. You also have the ability to decline or decrease the amount of your loan(s). Parent PLUS loans are automatically accepted; however, Subsidized/Unsubsidized and Graduate PLUS loans need to be accepted. To accept, decline or decrease your loan(s), choose the "Accept/Decline" link listed in the "Finances" section of your LionPATH Student Home Base. You can confirm that you have accepted your loan(s) and the amount accepted by viewing the ‘amount accepted’ on your Financial Aid Offer. Access the step-by-step tutorial for instructions at https://tutorials.lionpath.psu.edu/public/S_AcceptDeclineAid/ |

| Alternative loan for a prior enrollment period - contact us | We received a private student loan application for a prior enrollment period. Contact us at studentaid.psu.edu/contact-info to confirm which enrollment period you wish to borrow the loan. |

| Alternative loan do not want to file FAFSA - contact us | We have received your private student loan application, but your loan will be on hold until you take action. To continue processing, we need you to either: 1. Submit a Free Application for Federal Student Aid (FAFSA) or 2. Notify us that you do not want to take advantage of federal student loan options and want to proceed with only a private alternative loan. We recommend using all federal loan eligibility before turning to private loans. Submit a FAFSA at studentaid.gov to find out if you are eligible for federal student aid, including Federal Direct Loans, which may have more favorable terms and conditions than private alternative loans. If you complete the FAFSA and are offed federal student aid, we will automatically process your private alternative loan. More information on federal loan options is available on our website at studentaid.psu.edu/types-of-aid/loans. If you choose to not fill out the FAFSA, contact us via email at studentaid.psu.edu/contact-info. Your loan application will remain on hold until you complete one of the above actions. |

| Alternative loan unable to process- lender requires you to complete a FAFSA | Your loan request will not be processed until you complete the FAFSA or notify our office that you are not going to proceed with a private alternative loan from this lender. Notify us at studentaid.psu.edu/contact-info. |

| Alternative loan unable to process - not enrolled during requested loan period | We received a private student loan application for a loan period that does not match your enrollment periods; therefore, we are unable to process this request. Loan term periods are fall/spring, spring only, summer only, or fall only. Review your enrollment periods and contact your lender to reapply with an applicable loan period. |

| Alternative loan unable to process - you do not meet lender's requirements | We received a private student loan application, but cannot process the request because you do not meet the lender's requirements.To review the lender requirements and other loan options, visit our website at studentaid.psu.edu/types-of-aid/loans/private-alternative/apply. |

| PLUS unable to process - you must re-apply |

|

| PLUS unable to process - you are already at your maximum cost of attendance | We received a Direct PLUS loan, however, we are unable to process this application as your current financial aid has already reached your maximum cost of attendance. Federal regulations require that your total student financial aid, including loans, not exceed your cost of attendance/budget as listed on the Aid Summary in your Student Home Base. For more information on cost of attendance, copy and paste http://studentaid.psu.edu/tuition-costs/university-costs into your browser. |

| PLUS unable to process - no FAFSA on file. | We have received a Direct PLUS loan application, however, we are unable to process your request until you file a FASFA (Free Application for Federal Student Aid). Go to studentaid.gov to submit your FAFSA online. After your FAFSA is received, we will be able to proceed with processing your PLUS Loan request. |

| PLUS unable to process - you are not eligible for federal financial aid. | We received a Direct PLUS loan application, however, we are unable to process this request because you are ineligible to receive financial aid. Visit the Student Services Center in LionPATH to view the reason you are ineligible for aid. For a complete list of federal and Penn State financial aid eligibility requirements at http://studentaid.psu.edu/eligibility. |

| You are not eligible for federal financial aid | At this time, you are ineligible for aid. If you are a:

Please visit the Student Services Center in LionPATH to view the reason you are ineligible for aid. If you are an undergraduate student and have an offer of admission, but have not yet accepted your offer, please visit the Financial Aid section in your MyPennState profile to view the reason you are ineligible for aid. For a complete list of federal and Penn State financial aid eligibility requirements, please visit http://studentaid.psu.edu/eligibility. |

| You are not making Satisfactory Academic Progress |

Undergraduate Student: 2.0 Cumulative GPA Teacher Certificate Program Student: 3.0 Cumulative GPA Graduate/Professional Student: 3.0 Cumulative GPA Law Student: 2.0 Cumulative GPA |