Apply for Fall 2023 and Spring 2024

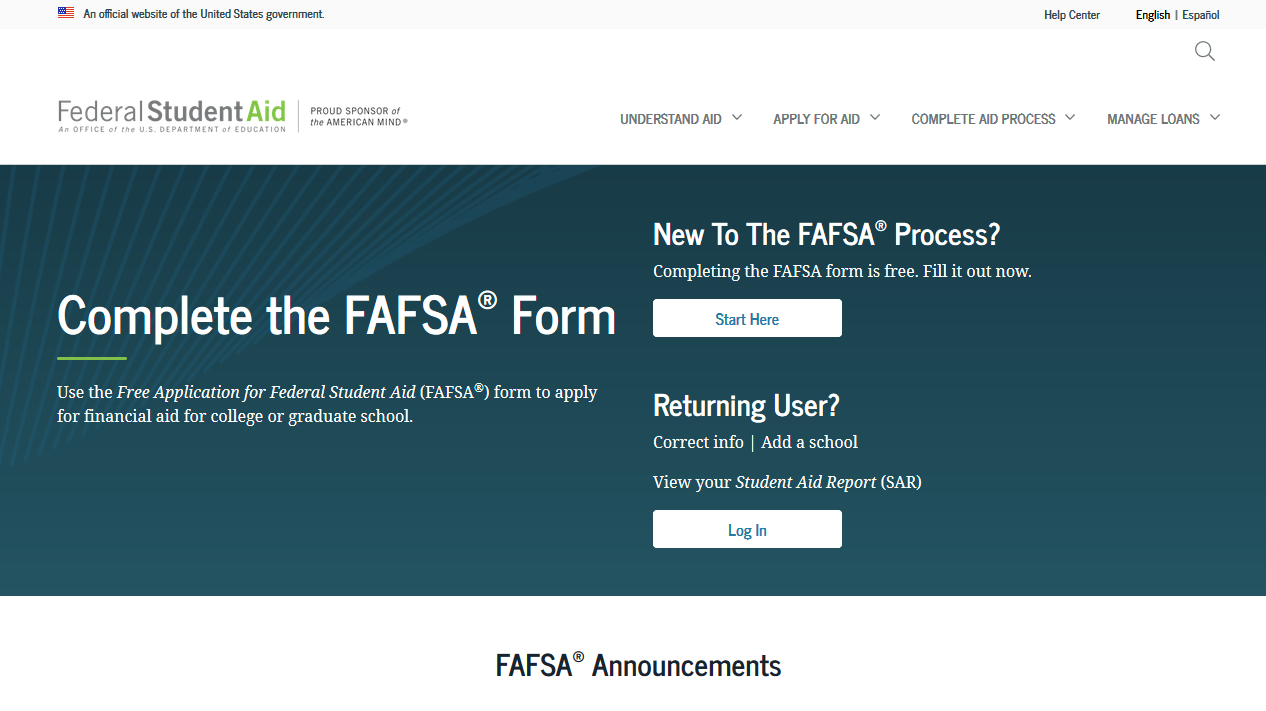

Once you have determined that you meet the basic State and/or Federal aid eligibility requirements, you are ready to apply. To apply for financial aid for 2023-24 you must complete the Free Application for Federal Student Aid.

Free Application for Federal Student Aid (FAFSA)

We recommend that every student fill out the FAFSA. The FAFSA is available beginning October 1 of the year prior to which you plan to enroll. There are two ways to submit the FAFSA form:

Recommended Submission Dates

For maximum consideration of financial aid, we recommend that you submit your FAFSA by the following dates:

- December 1, 2022 for all students who are new to Penn State

- April 15, 2023 for all students returning to Penn State

- May 1, 2023 for Pennsylvania residents who are interested in applying for the Pennsylvania State Grant*

*If you are a resident of a state other than Pennsylvania, please verify if you are eligible for a state grant and what your deadline is with your own state grant agency

Requirements

Take your time when completing the FAFSA. Entering incorrect or incomplete names, dates or birth, or social security numbers may cause a delay in the processing of your financial aid.

To complete the FAFSA, you and/or your parents will need to:

- Insert Penn State’s federal school code: 003329

- Enter your name and Social Security number exactly as it appears on your Social Security card (include suffixes and your middle name/initial)

- For dependent students: Provide your parent(s) name and social security number exactly as it appears on their Social Security card (including suffixes and middle name/initial).

- For independent married students: Provide your spouse's name and social security number exactly as it appears on their Social Security card (including suffixes and middle name/initial).

- Provide your valid driver’s license number (if you have one)

- Enter the dates of birth of all persons you are listing on your FAFSA

- Provide your alien registration number (for eligible non-citizens)

- Mark your individual status information (marital status, veteran, etc.)

- Supply 2021 federal tax information, including adjusted gross income, earnings from work, income tax paid, etc.

- Also gather records of untaxed income or investments (if applicable)

- Have a FSA ID to sign electronically

You can find a question by question guide to on the Federal Student Aid site.

Internal Revenue Service Data Retrieval Tool (IRS DRT)

The IRS DRT is available to use with the 2023–24 FAFSA form. The IRS DRT remains the fastest, most accurate way to input your tax return information into the FAFSA form. There are some populations that will be ineligible to use the DRT tool:

- The student/parent is married, and either the student/parent or their spouse filed as Married Filing Separately.

- The student/parent is married, and either the student/parent or their spouse filed as Head of Household.

- The parents’ marital status is “Unmarried and both legal parents living together.”

- The student/parent filed a Puerto Rican or foreign tax return.

Who is my parent when I fill out the FAFSA?

Dependent students are required to provide their parent(s) tax information on the FAFSA. For reporting purposes, "parent" means your legal (biological or adoptive) parent or stepparent, or a person determined to be your legal parent. Federal Student Aid can help you to determine who to report as your parent on the FAFSA.

After your FAFSA is submitted - Verification

We may be required to contact you to request documentation to verify your FAFSA information. Please respond quickly to any and all requests by the Office of Student Aid to ensure timely disbursement of your student aid. For information on where to view this information in LionPATH visit our page on Verification Selections.