Apply for Fall 2024 and Spring 2025

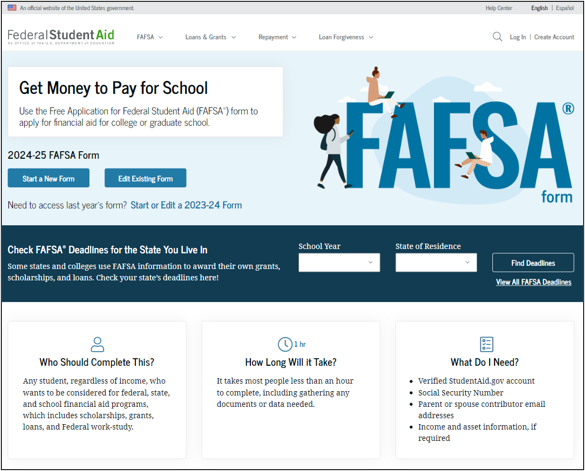

Once you have determined that you meet the basic State and/or Federal aid eligibility requirements, you are ready to apply. To apply for financial aid you must complete the Free Application for Federal Student Aid.

Free Application for Federal Student Aid (FAFSA)

We recommend that every student fill out the FAFSA. The FAFSA is typically available beginning October 1 of the year prior to which you plan to enroll. Because there were major updates to the 2024-2025 FAFSA, it launched on December 31, 2023.

The 2024–25 Free Application for Federal Student Aid (FAFSA®) form is available periodically as part of a soft launch. During the soft launch, the FAFSA form will be available for short periods of time while site performance and form functionality are monitored. Pauses will occur for site maintenance and to make technical updates as needed to provide you with a better experience. Be patient, you have plenty of time to submit the application and meet our recommended deadlines.

Recommended Submission Dates

For maximum consideration of financial aid, we recommend that you submit your FAFSA by the following dates:

- February 15, 2024 for all students who are new to Penn State (or at your earliest convenience)

- April 15, 2024 for all students returning to Penn State

- May 1, 2024 for Pennsylvania residents who are interested in applying for the Pennsylvania State Grant*

*If you are a resident of a state other than Pennsylvania, please verify if you are eligible for a state grant and what your deadline is with your own state grant agency

The processing of the 2024-25 Free Application for Federal Student Aid (FAFSA) has been delayed for all schools. Although we will not meet our original March new student awarding timeline, we will review the results of your FAFSA as soon as it arrives. When we know more, we will update you.

We also realize that many of you want to make changes to your 2024-25 information and have not been able to access your FAFSA. We are aware of this and want to assure you that it is OK. Please continue to submit your initial FAFSA at your earliest convenience.

This delay impacts students who are new to Penn State. Continuing students have plenty of time to submit and make changes to their 2024-25 FAFSA.

Requirements

Take your time when completing the FAFSA. Entering incorrect or incomplete names, dates or birth, or social security numbers may cause a delay in the processing of your financial aid.

To complete the FAFSA, you and/or your parents will need to:

- Insert Penn State’s federal school code: 003329

- Enter your name and Social Security number exactly as it appears on your Social Security card (include suffixes and your middle name/initial)

- For dependent students: Provide your parent(s) name and social security number exactly as it appears on their Social Security card (including suffixes and middle name/initial).

- For independent married students: Provide your spouse's name and social security number exactly as it appears on their Social Security card (including suffixes and middle name/initial).

- Provide your valid driver’s license number (if you have one)

- Enter the dates of birth of all persons you are listing on your FAFSA

- Provide your alien registration number (for eligible non-citizens)

- Mark your individual status information (marital status, veteran, etc.)

- Supply 2022 federal tax information, including adjusted gross income, earnings from work, income tax paid, etc.

- Have a FSA ID to sign electronically

A question by question guide will be available on Federal Student Aid at a later date.

The IRS DRT will become the FA-DDX

The Fostering Undergraduate Talent by Unlocking Resources for Education Act (FUTURE Act) requires the Department of Education to access tax information held by the IRS pertaining to FAFSA applicants—and, where applicable, their parents and spouses—through a secure method: the FUTURE Act Direct Data Exchange (FA-DDX).

Any student/parent who filed a Puerto Rican or foreign tax return will still be required to manually input their tax data..

Who is my parent when I fill out the FAFSA?

Dependent students are required to provide their parent(s) tax information on the FAFSA. For reporting purposes, "parent" means your legal (biological or adoptive) parent or stepparent, or a person determined to be your legal parent. Federal Student Aid can help you to determine who to report as your parent on the FAFSA.

Who is a contributor on the FAFSA?

“Contributor” is a new term being introduced on the 2024–25 FAFSA form. A contributor is anyone (you, your spouse, your biological or adoptive parent, or your parent’s spouse) who is required to provide information on the FAFSA form, sign the FAFSA form, and provide consent and approval to have their federal tax information transferred directly from the IRS into the form.

Determine who is a contributor on the FAFSA.

Each contributor on the FAFSA should create an account, username, and password (FSA ID) with a unique email address. For those that have applied previously, this is a change.

After your FAFSA is submitted - Verification

We may be required to contact you to request documentation to verify your FAFSA information. Please respond quickly to any and all requests by the Office of Student Aid to ensure timely disbursement of your student aid. For information on where to view this information in LionPATH visit our page on Verification Selections.

Do you need more information?

Visit 2024-25 FAFSA Resources.