Federal Direct Loans and Default

For a Federal Direct Student or Parent Plus Loan, default occurs when the borrower fails to make a payment for 270 days under the normal repayment plan, and has not requested deferment of payment according to the Department of Education's standards.

How do I know if I am in default?

The National Student Loan Data System (NSLDS) is the U.S. Department of Education's (ED's) central database for student aid. NSLDS receives data from schools, guaranty agencies, the Direct Loan program, and other Department of ED programs. NSLDS Student Access provides a centralized, integrated view of Title IV loans and grants so that recipients of Title IV Aid can access and inquire about their Title IV loans and/or grant data.

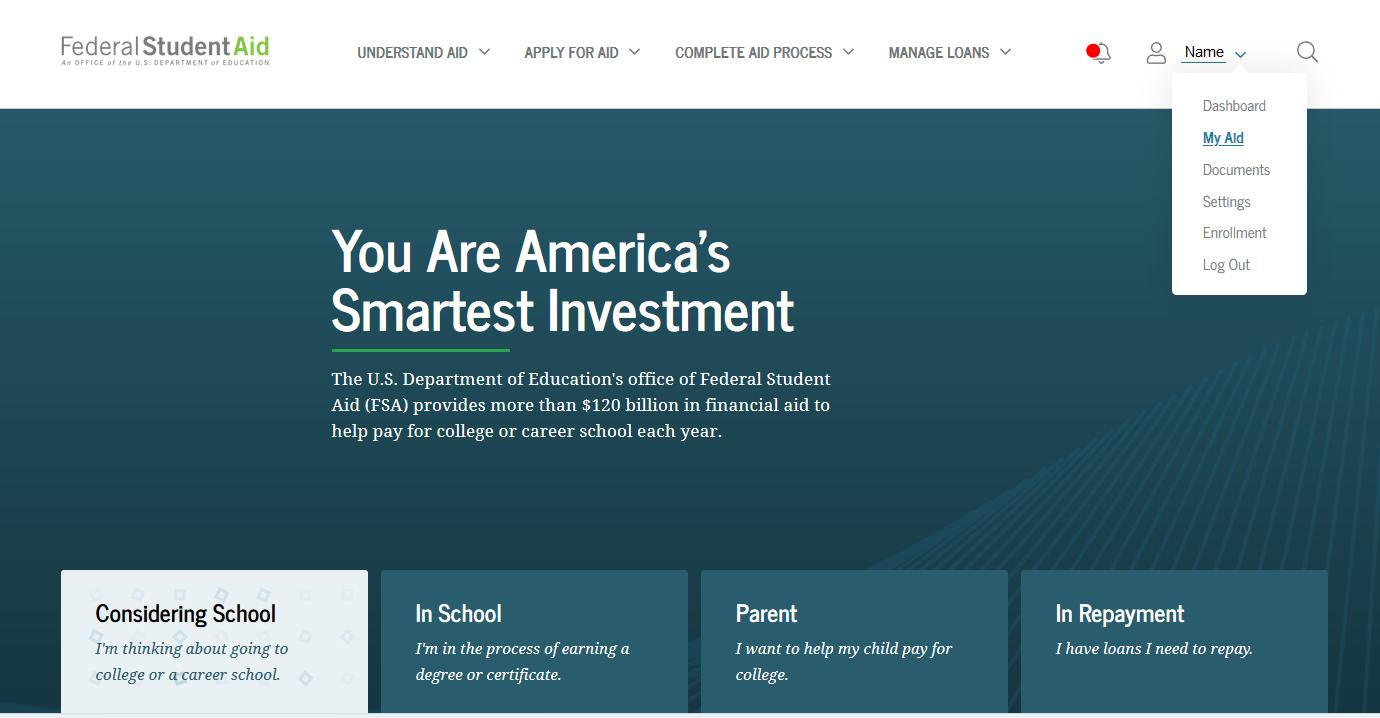

In order to access your federal loan information, and current loan servicer, please visit studentaid.gov.

1. Log into your account with your FSAID and select "My Aid" from the drop down menu:

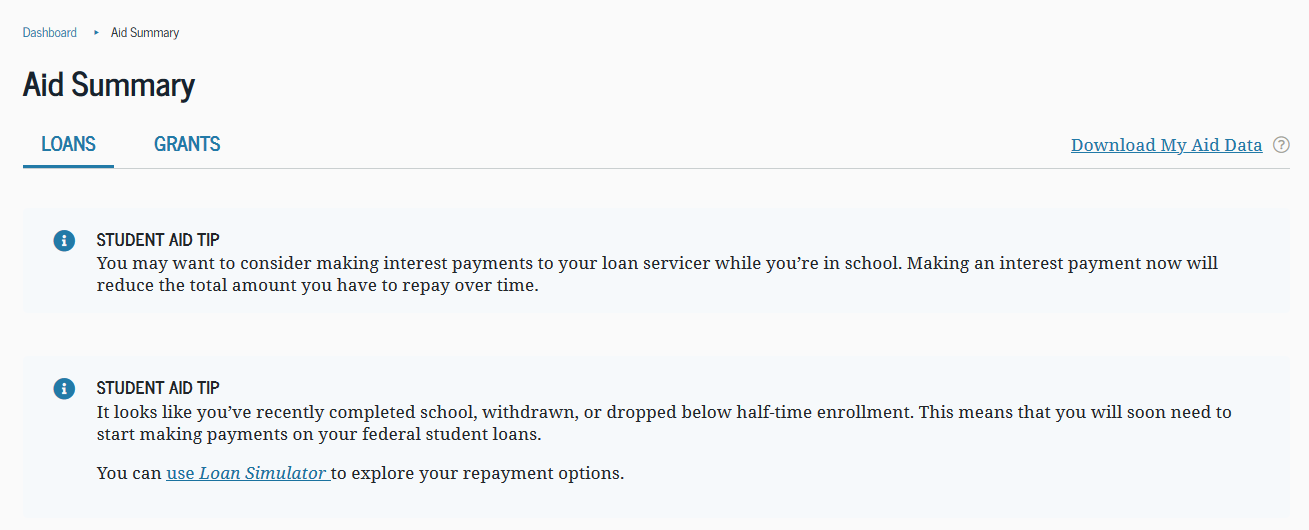

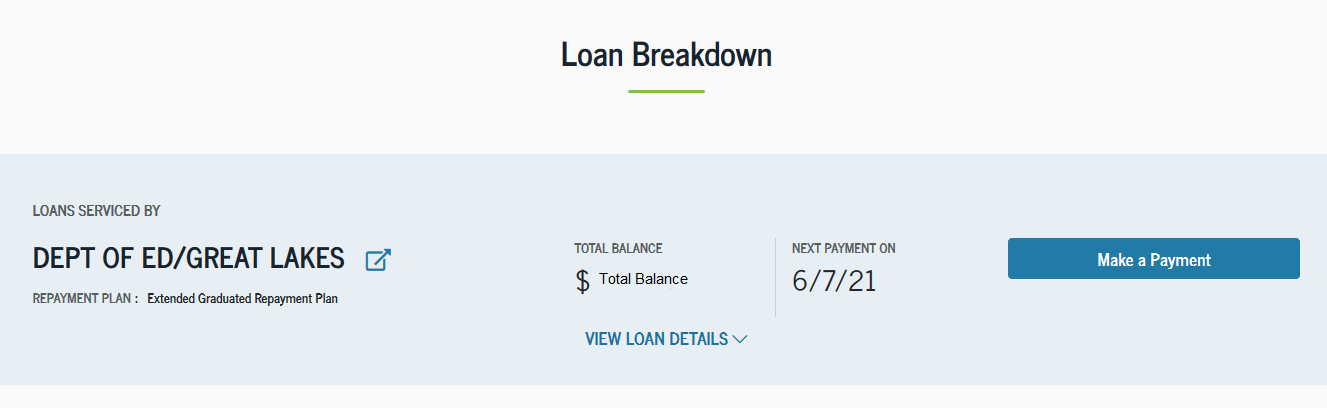

2. View your loan summary:

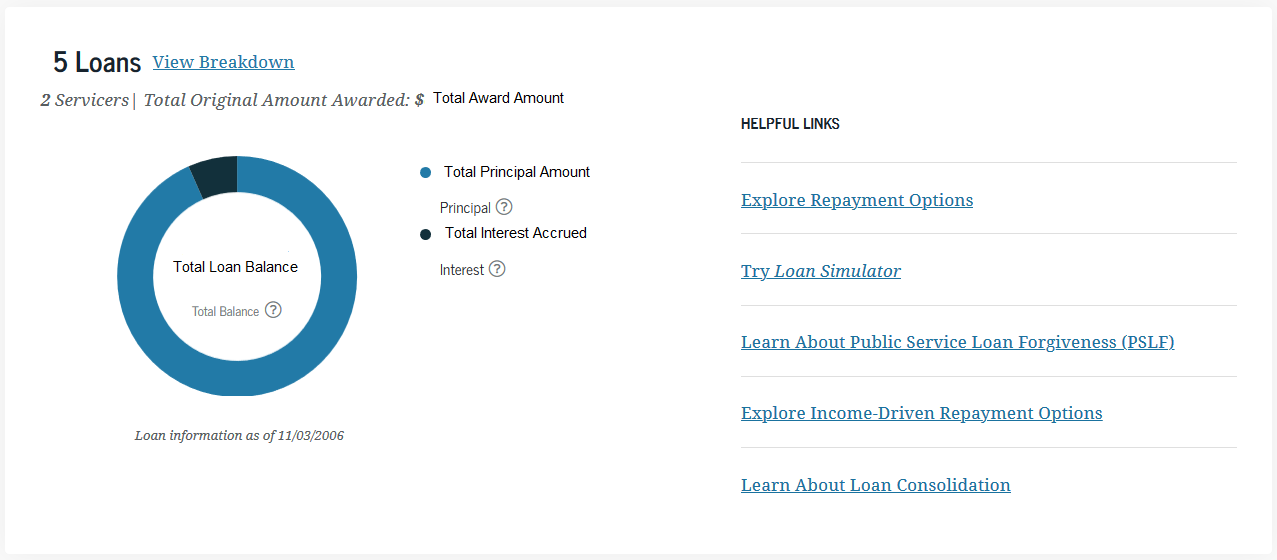

3. View loan servicer information:

Note: “My Federal Student Aid” will not include information about any private student loans you may have received. Contact the loan holder of your private student loans for loan information.

How do I get out of default?

One way to get out of default is to repay the defaulted loan in full, but that may not be a practical option for most borrowers. The two main ways to get out of default are loan rehabilitation and loan consolidation. While loan rehabilitation takes several months to complete, you can quickly apply for loan consolidation. However, loan rehabilitation provides certain benefits that are not available through loan consolidation.

Rehabilitation vs. Consolidation of a defaulted Federal loan

| Rehabilitation | Consolidation |

|

If you rehabilitate a defaulted loan, the record of the default will be removed from your credit history. However, your credit history will still show late payments that were reported by your loan holder before the loan went into default. |

If you consolidate a defaulted loan, the record of the default (as well as late payments reported before the loan went into default) will remain in your credit history. |

Loan Rehabilitation:

To start the loan rehabilitation process, you must contact your loan holder. If you’re not sure who your loan holder is, you can log into studentaid.gov to get your loan holder’s contact information.

A loan will be rehabilitated once the borrower makes nine consecutive, full, voluntary payments on time, within 20 days of the due date, and makes all nine payments during a period of 10 consecutive months. Once the loan has been rehabilitated, the student will receive normal loan benefits, such as deferments. Payments must be made within twenty days of the due date during ten consecutive months.

For a Perkins loan, you must make a full monthly payment each month, within 20 days of the due date, for nine consecutive months. Your required monthly payment amount is determined by your loan holder

If you rehabilitate a defaulted loan and then default on that loan again, you can’t rehabilitate it a second time. Rehabilitation is a one-time opportunity.

Loan Consolidation

Another option for getting out of default is to consolidate your defaulted federal student loan into a Direct Consolidation Loan. Loan consolidation allows you to pay off one or more federal student loans with a new consolidation loan.

To consolidate a defaulted federal student loan into a new Direct Consolidation Loan, you must either:

- Agree to repay the new Direct Consolidation Loan under an income-driven repayment plan

- Make three consecutive, voluntary, on-time, full monthly payments on the defaulted loan before you consolidate it

Note: If you choose to make three payments on the defaulted loan before you consolidate it, the required payment amount will be determined by your loan holder, but cannot be more than what is reasonable and affordable based on your total financial circumstances.