Private Alternative Loan Timeline To Disbursement

Due to Federal Regulations (TILA), Private Alternative Loans have a 10 day right of rescission once the loan has been approved and before the disbursement can be requested. Plan ahead and apply early to avoid delays in funding.

Loan Certification

Once your loan is approved by your lender and your Private Alternative loan application is finalized, a certification request will be sent to the school. This is when we check that you meet the eligibility criteria specified by your lender for your particular loan. If we are unable to certify your loan, we will send you a message explaining the issue.

Eligibility will include items such as:

- Enrollment – Does your lender require half time enrollment? Have you withdrawn from the semester?

- Level – If you are an undergraduate student, did you apply for an undergraduate loan?

- Academic Progress – Does your lender require you to be meeting SAP?

- Degree Status - Does your lender require you to be in a degree-seeking program?

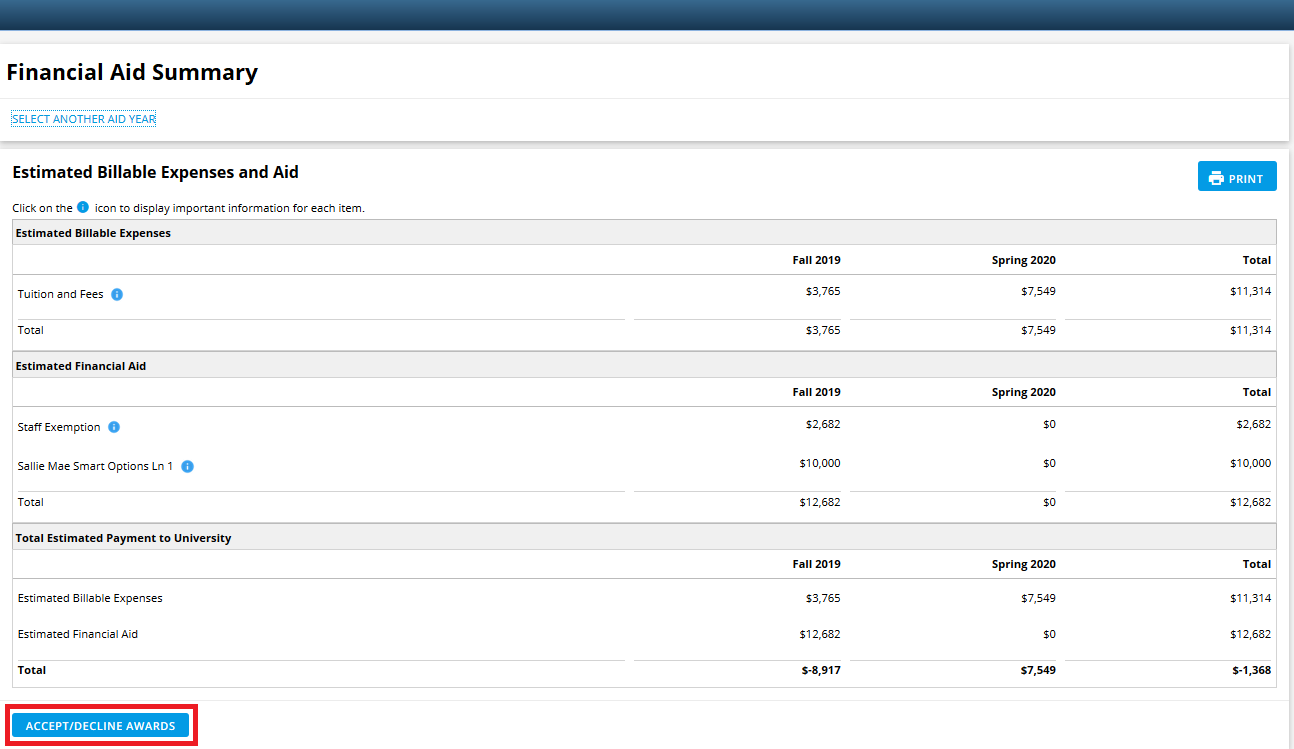

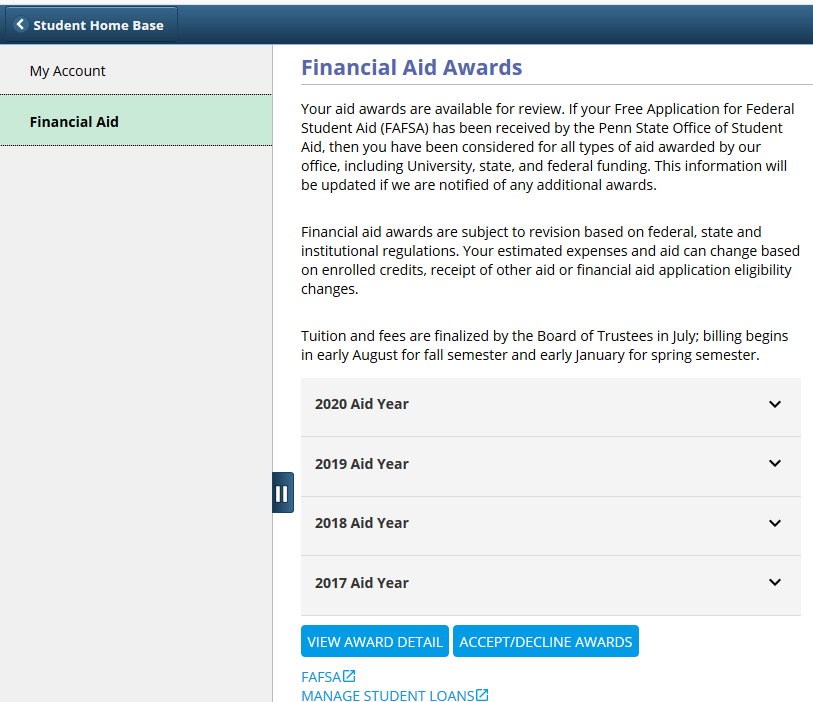

If we certify the loan, it will appear in your Financial Aid Offer in LionPATH. Your loan will not appear as a credit on your bill and will not disburse until you have accepted the loan.

To accept your loan, you must:

- Check the accuracy of the loan term and amounts before accepting the loan. A Fall/Spring loan will be split evenly between the two semesters. If you need varying amounts, you may want to consider a Fall-only and a Spring-only loan instead. If you need to change your loan term date, this can only be done before you have accepted the loan.

- An Increase is not possible after the loan is accepted in LionPATH. If you wish to increase the loan amount after the loan is certified, you will need to submit a new application with the lender for the additional amount needed.

- Accept each private alternative loan via your LionPATH Financial Aid Offer.

Once the loan(s) has been accepted, it will take 2-3 business days for your loan to show as anticipated aid (a credit toward your charges) on your statement. Monitor your account at your lender for updates or any additional items that may need to be completed.

Loan Disclosures

Plan ahead when applying for an alternative loan and be sure to complete all items requested by the lender. This process can take 2-3 weeks to complete.

Keep in mind that due to the Federal Truth In Lending Act (TILA) regulations:

- The date of disbursement of your loan cannot be changed.

- You will have a 10 day right of rescission once the loan has been approved, before the disbursement can be requested. This is a period where disbursements are held in order for you to have a final chance to change your mind and cancel the loan without penalty.

- Contact us to reduce your loan.

TILA requires you to complete and submit a self-certification form to your lender for each individual application:

- If your lender does not provide the form, print and complete the Private Education Loan Applicant Self-Certification.

- You can find your cost of attendance and estimated aid for the period of enrollment covered by the loan in your Financial Aid Offer in LionPATH.

- Return the self-certification form to your lender.

TILA also requires lenders to provide you with three disclosures:

- Upon the completion of your loan application

- When you are approved for your loan

- At least three days prior to the disbursement of your loan

View a sample loan disclosure here.

Disbursements

You must maintain eligibility in order for your loan to disburse. If you drop to less than half-time or withdraw before your loan disburses or you no longer meet the requirements of the lender, then your loan will be cancelled.

We will begin to request disbursement of funds 10 days prior to the beginning of a semester and on an on-going basis thereafter. Monitor your LionPATH and the account that you have established at your lender to be sure that you are completing all of the steps required to have your funds approved and disbursed in a timely manner.

Summer term

Summer loans will not be disbursed at the beginning of the semester. The disbursement date will be 10 days prior to the start of Session II. For Summer 2022, the date will be June 20, 2022. Short term loans are available at your campus aid office for students who have started their classes in May and are expecting a refund to pay for living expenses.

Pay special attention to your loan disclosures to determine the actual disbursement date of your alternative loan funds. This date cannot be changed.

Credit Union Loans

You are able to apply for a private alternative loan through any lender of your choice. However, be aware that some lenders do not have an electronic certification process, which may cause a significant delay in the time it takes to certify the loan and disburse the loan funds. Check with your lender regarding their certification and disbursement process and apply early to prevent any delays.

Disclaimer

Penn State cannot in any way be held liable in the event the borrower is dissatisfied with the rates, terms, or service provided by any lender.